do pastors pay taxes on their homes

This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. Furthermore self-employment tax is 153 percent as of the 2013 tax year.

From the 15th century to the 19th century most pastors lived in the parsonage a house provided by the church.

. But for a pastor there are two sides to taxesthe federal and the SECA. If your state law does not exempt parsonages from taxation then there is no point in the pastor transferring title to his home to the church if his only purpose is to avoid paying property taxes. In about 15 states parsonages are exempt from property taxes.

It is illegal for a church to withhold FICA taxes for a minister ministers pay SECA taxes not FICA Fact. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. The amount excluded cant be more than reasonable compensation for the ministers services.

By the early 20th century though both clergy housing and taxation had changed considerably. Churches do not automatically withhold taxes like it would for a standard employee. With the Regular Method you divide expenses.

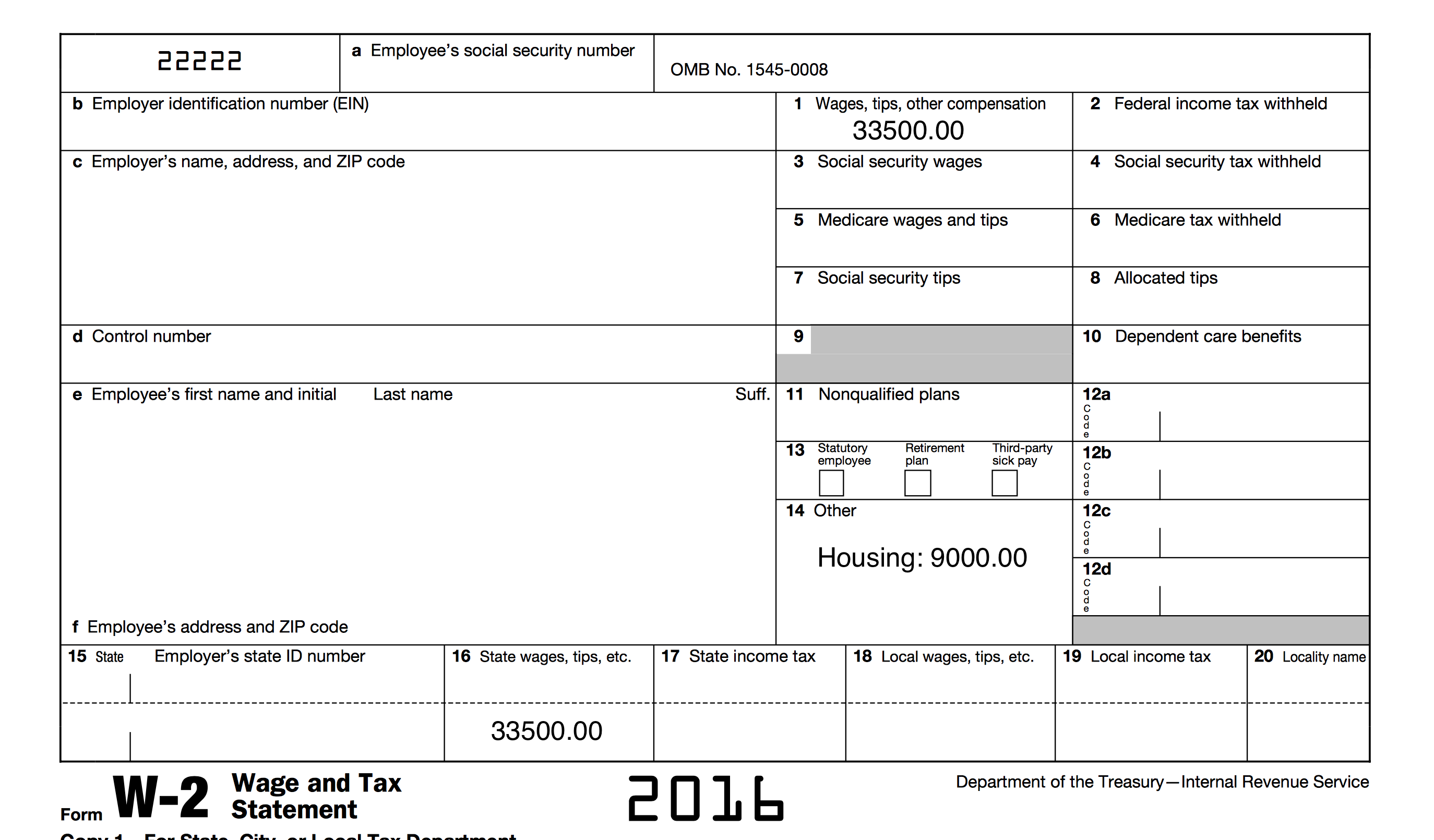

Housing costs would qualify for the housing allowance so you wouldnt have to pay federal income taxes but you would have to pay self-employment taxes if you havent opted out of Social Security. It can be confusing especially for those who are new pastors or those who are new to this allowance. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount.

Ministers cannot ask the church to voluntarily withhold their Federal and State taxes. If a church withholds FICA taxes for a. Housing was thus a form of non-cash payment that was exempt from taxation since the parsonage was church property.

If your church pays your bills that would be considered compensation. The home office deduction is subtracted from your self-employment income on Schedule C. A Local 10 investigation found pastors living in multi-million dollar homes exempt from paying property taxes -- because their homes are owned by churches.

There are two methods of calculating the actual deduction the Regular Method and the Simplified Method. If that is the case the church should withhold income taxes only not Social Security taxes which you must pay quarterly throughout the year. If the pastor continues to live in the home it becomes in effect a church-owned parsonage.

Generally those expenses include rent mortgage interest utilities and other expenses directly relating to providing a home. Instead clergy can pay income taxes in quarterly installments throughout the year. The pastor can use the tax-free housing allowance to make mortgage payments on a home and then write.

The big difference is that with self-employment tax pastors have to pay both their share of the contribution and the employer share and they pay it out-of-pocket. If you make arrangements with your church you can elect voluntary withholding. A minister may ask the church to withhold a dollar.

If you own your home you may still claim deductions for mortgage interest and real property taxes. You can use the deduction to reduce your income down to 0 but it cannot create a loss negative income. FICASECA Payroll Taxes.

In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. A Local 10 investigation found pastors living in multi-million dollar homes exempt from paying property taxes -- because their homes are owned by churches. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes.

The housing allowance will allow you to reduce your federal taxes by the amount of your allowance and thus reduce your federal taxable income.

2014 Pastor S Compensation Benefits

Why Don T Preachers Pay Taxes And Do You Think It S Fair Quora

When A Pastor S House Is A Church Home Why The Parsonage Allowance Is Desirable Under The Establishment Clause The Federalist Society

The Pros And Cons Of A Housing Or Parsonage Allowance

How To Set The Pastor S Salary And Benefits Leaders Church

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

What To Do If Your Clergy Housing Allowance Exceeds Your Actual Expenses The Pastor S Wallet

Everything Ministers Clergy Should Know About Their Housing Allowance

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Gusto Setup Tax Exemptions For Pastors Ministers Or Clergy Support Center

Do Pastors Pay Taxes In Canada Ictsd Org

Five Things You Should Know About Pastors Salaries Church Answers

How Pastors Pay Federal Taxes The Pastor S Wallet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet